Adani Power settles a tad above

Adani Power settled at Rs 100.05 on BSE, at almost the same level as the initial public offer

Managing Inflation by being Vigilant and Proactive One should always account for Inflation while targeting any goals. Inflation causes significant increase in value of expenses over the years [refer to below mentioned graph].

To beat inflation, one should have exposure to instruments which have potential to outperform inflation. Only some of the expenses like Term insurance premium, loan EMIs are generally fixed where investor is not impacted by Inflation.

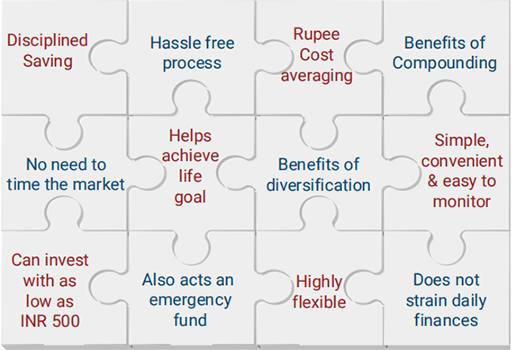

SYSTEMATIC INVESTMENT PLAN (SIP) Systematic Investment Plans, called SIPs, helps the investor create wealth over the long term through small and consistent investments. By making small, disciplined savings in mutual fund schemes over a period of time, these plans bring the investor closer to realizing his/her financial goals. Simply put, a SIP is an investment option or approach to invest a fixed amount in any fund or scheme at regular intervals. By investing across market phases, whether bullish or bearish, this approach ensures that the cost of investment averages out over a period of time.

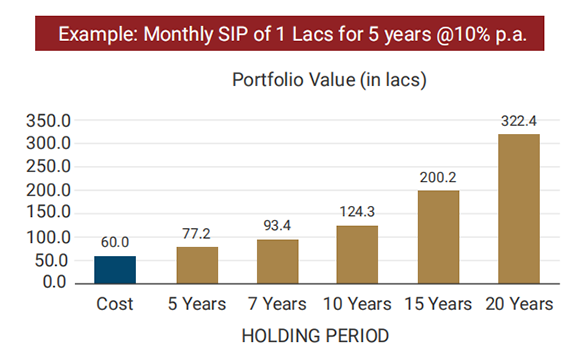

If you invest Rs. 1 lac per month for a period of 5 years and then stay put for next 15 years (at end of 20th year), you would arrive at a portfolio value of Rs. 3.22 cr assuming a 10% return per year.

You have just started building your retirement corpus

You have a corpus and still building actively.

You are retiring or soon to retire and planning for your immediate retirement

You have retired

ICICI Securities Ltd.( I-Sec). AMFI Regn. No.: ARN-0845. PFRDA registration numbers: POP no -05092018. I-Sec acts as a Composite Corporate agent having registration number –CA0113. Mutual Fund Investments are subject to market risks, read all scheme related documents carefully. Please note, Mutual Fund, Corporate Fixed Deposits, Bonds, Alternate investment funds, Tax planning, Succession planning and Loans related services are not Exchange traded products and I-Sec is acting as a distributor to solicit these products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. Please note, Insurance related services are not Exchange traded products and I-Sec is acting as a corporate agent to solicit these products. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Account would be open after all procedure relating to IPV and client due diligence is completed.