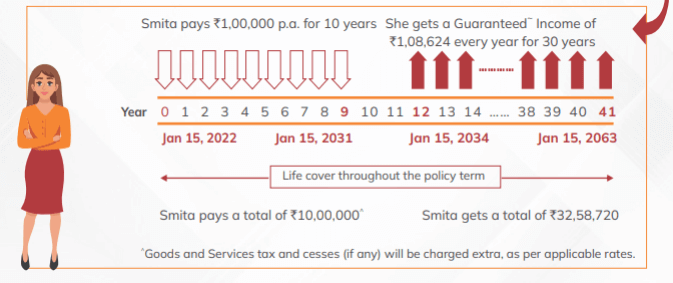

Policy Returns

Invested ₹1 Lakh for 10 years with policy term 11 years after maturity for next 11 year get guaranteed income of

₹2.05 lakh yearly

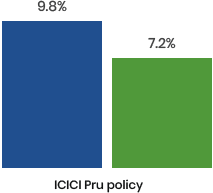

- Absolute Return

- Return after tax

Invest

Invest

Brochure

Brochure