Decide the plan option, level of life cover, premium amount, premium payment option and policy term to match your financial protection and savings needs

ICICI Pru Signature - a savings and protection oriented unit linked insurance plan, designed for the preferred customer like you. Along with a life cover to secure your family in case you are not around, this plan offers flexible savings options to help you achieve your goals.

Decide the plan option, level of life cover, premium amount, premium payment option and policy term to match your financial protection and savings needs

Choose the Portfolio Strategy and funds you want to save in

In case of your unfortunate death during the policy term, your nominee/ legal heir will receive the death benefit

On maturity of the policy, get maturity benefit as a lump sum or as periodic payouts through settlement option

Target Asset Allocation Strategy - This strategy enables you to choose an asset allocation that is best suited to your risk appetite and maintains it throughout the policy term.

Trigger Portfolio Strategy 2 - Under this strategy, your savings will initially be distributed between two funds Multi Cap Growth Fund, an equityoriented fund, and Income Fund, a debt oriented fund in a 75%:25% proportion. The fund allocation maysubsequently get altered due to market movements

Fixed Portfolio Strategy - This strategy enables you to manage your savings actively. Under this strategy, you can choose to save your monye in any of the following fund options in proportions of your choice.

Lifecycle based Portfolio Strategy 2 - Your financial needs are not static and keep changing with your life stage. It is, therefore, necessary that your policy adapts to your changing needs. This need is fulfilled by the Lifecycle based Portfolio Strategy 2

Looking for better renurns?

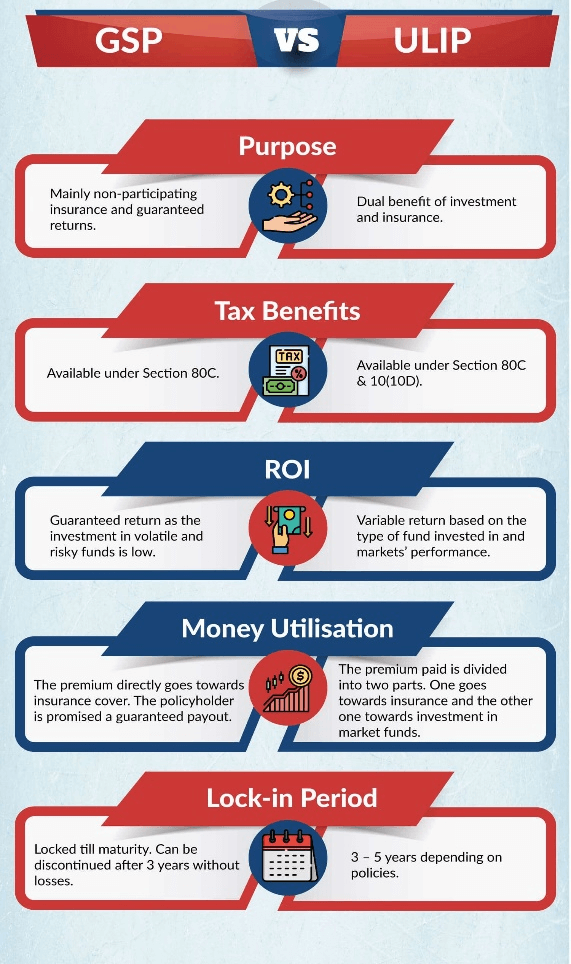

View Plans with Better ReturnsYou may receive tax free maturity amount under Sec 10(10D) and tax rebate on premium paid under Sec 80 C.

Refer the table attached

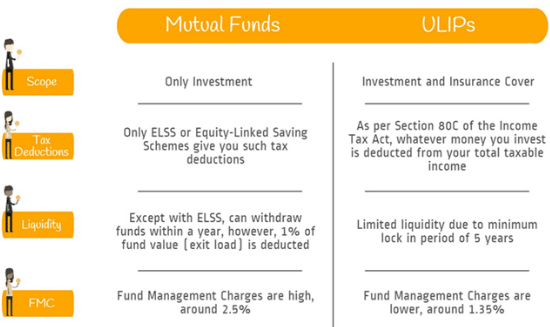

| Features | ELSS | ULIP |

| Investment Porfolio | Equity heavy portfolio, An ELSS fund has a minimum of 65% of equity stocks. Generally, ELSS funds have 80-85% of equity, |

In a ULIP, you are given full freedom to decide how much of your money will be invested and in which fund. thus, you can choose to invest in the following equity and debt as per your preference

|

| Lock-In Period | ELSS have a lockin period of 3 years | ULIP plans have a lockin period of 5 years |

| Tax savings | ELSS is eligible for deduction of up to Rs 1.5 lakhs u/s 80C | Tax deductions of up Rs 1.5 lakhs u/s 80C available. Tax-exemption also available on maturity amount u/s 10(10)D |

| Tax on Maturity/Withdrawal | LTCG tax @ 10% if the gains exceed Rs 1 lakh | Returns can taxable if the premium you pay exceeds Rs 2.5 lakhs per year. |

| Chargrs | ELSS funds invoive charges such as exit-load, management charges. |

ULIPs invoive charges such as:

|

| Expense Ratio | It has a low expense ratio in the range of 0.5% to 1.5% | Charges are capped at 1.35% |

| Life Cover | No life cover is present | Life cover is provided in ULIPs death benefit is payable to the family at the time of your death |

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.

Lorem Ipsum is simply dummy text of the printing and typesetting industry. Lorem Ipsum has been the industry's standard dummy text ever since the 1500s, when an unknown printer took a galley of type and scrambled it to make a type specimen book.