Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

- Nexus Select Trust is a Sebi-registered real estate investment trust (acquirer REIT) and is backed by global investment firm Blackstone

- Trust has 100 per cent shareholding of 15 entities and indirect acquisition of 100 per cent shareholding of two entities acting through acquirer REIT's manager -- Select Infrastructure Pvt Ltd and Nexus South Mall Management Pvt Ltd

- These urban consumption centres are spread across cities such as Bengaluru, Chennai, Delhi, Hyderabad, Navi Mumbai, Pune etc.

Large and diversified asset portfolio with reputed tenant profile

The assets are situated in prominent micro-markets of the respective cities, thereby enhancing its marketability and also has established operating track record. The reputed tenant profile is reputed and consists of groups like Reliance Retail, Landmark Group, PVR, Tata & Trent, Cinepolis etc. The NOI contribution from top 3 urban consumption centres was 44% and contribution from other assets was 14%. The portfolio is likely to benefit from operational and financial synergies due to the large retail portfolio.

Track record of sponsor and manager

The Trust’s portfolio is majority owned by the Blackstone Group through its affiliates. Blackstone is one of the India’s leading landlord for office, retail urban consumption centres and warehousing assets. The Trust is to be managed by Nexus Select Mall Management Private Limited, which is currently 100% owned by Blackstone. The established track record of the sponsor group in the real estate sector and the diversified portfolio in retail real estate business in India provide comfort. The portfolio is likely to benefit from the experienced management team and strong parentage.

Exposure to refinance risk

A part of the debt at the consolidated level after Trust formation is expected to be in the form of NCDs or loans with bullet principal repayments at different maturities exposing the company to refinancing risk. The risk is likely to be mitigated to an extent with the tranching of the issuances with well-spread-out maturities and the financial flexibility of Trust due to low leverage.

Vulnerability to external factors including outbreak of pandemic

The Trust’s portfolio is exposed to the risks from the cyclicality in the sector and vulnerability to external factors such as the Covid-19 pandemic which could impact the cash flows of the Trust. The recovery of the urban consumption centres’ operations to pre-pandemic level on the back of improved demand, after the outbreak of the pandemic, which disrupted the urban consumption centres’ operations in FY2021 and FY2022, mitigates the risk to an extent.

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

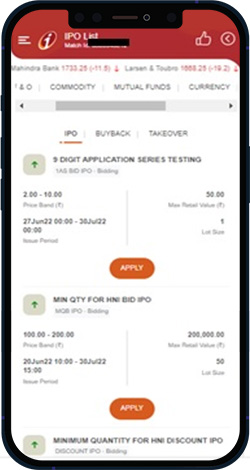

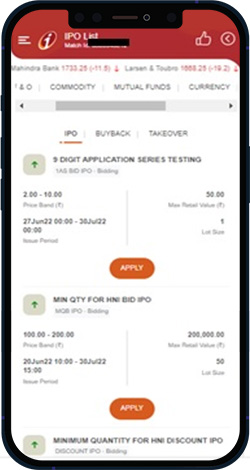

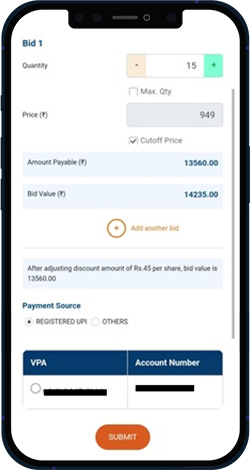

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

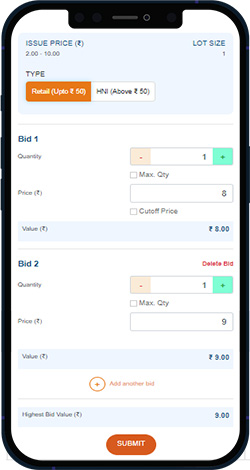

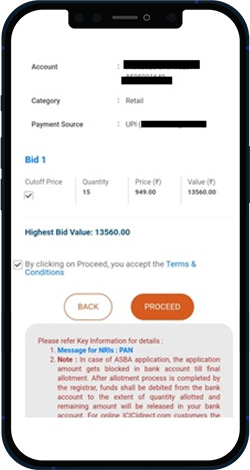

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

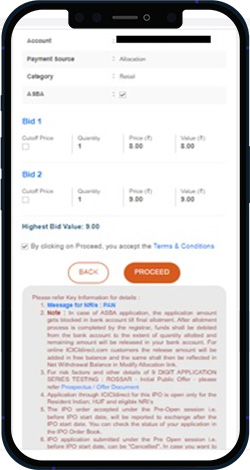

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.