Price Range (₹)

Price Range (₹)

Issue Size (₹ in Cr.)

Minimum Quantity

Bidding Period

In case of any revision in the Price Band, the Bid/Offer Period will be extended by at least three additional Working Days after such revision in the Price Band, subject to the Bid/Offer Period not exceeding 10 Working Days. In cases of force majeure, banking strike or similar circumstances, our Company may, for reasons to be recorded in writing, extend the Bid/Offer Period for a minimum of three Working Days, subject to the Bid/Offer Period not exceeding 10 Working Days. Any revision in the Price Band and the revised Bid/Offer Period, if applicable, shall be widely disseminated by notification to the Stock Exchanges, by issuing a public notice, and also by indicating the change on the respective websites of the Book Running Lead Managers and at the terminals of the Syndicate Members and by intimation to Designated Intermediaries and the Sponsor Bank, as applicable. The Offer is being made through the Book Building Process, in terms of Rule 19(2)(b) of the Securities Contracts (Regulation) Rules, 1957, as amended (“SCRR”) read with Regulation 31 of the SEBI ICDR Regulations and in compliance with Regulation 6(1) of the SEBI ICDR Regulations, wherein not more than 50 % of the Net Offer shall be allocated on a proportionate basis to Qualified Institutional Buyers (“QIBs”, the “QIB Portion”), provided that our Company may, in consultation with the Book Running Lead Managers, allocate up to 60% of the QIB Portion to Anchor Investors on a discretionary basis in accordance with the SEBI ICDR Regulations (“Anchor Investor Portion”), of which one-third shall be reserved for domestic Mutual Funds, subject to valid Bids being received from domestic Mutual Funds at or above the Anchor Investor Allocation Price. In the event of under-subscription, or non-allocation in the Anchor Investor Portion, the balance Equity Shares shall be added to the Net QIB Portion. Further, 5% of the Net QIB Portion shall be available for allocation on a proportionate basis only to Mutual Funds, and the remainder of the Net QIB Portion shall be available for allocation on a proportionate basis to all QIBs, including Mutual Funds, subject to valid Bids being received at or above the Offer Price. However, if the aggregate demand from Mutual Funds is less than 5% of the Net QIB Portion, the balance Equity Shares available for allocation in the Mutual Fund Portion will be added to the remaining Net QIB Portion for proportionate allocation to all QIB Bidders (other than Anchor Investors). Further, not less than 15% of the Net Offer shall be available for allocation on a proportionate basis to Non-Institutional Bidders and not less than 35% of the Net Offer shall be available for allocation to Retail Individual Bidders in accordance with the SEBI ICDR Regulations, subject to valid Bids being received at or above the Offer Price

| Retail Individual Investor | |

| Non-Institutional Investor | |

| Qualified Institutional Buyers | |

| Overall |

Applications

refunds

Convenient investments

of application

For ICICI Bank linked A/c

For non ICICI Bank A/c

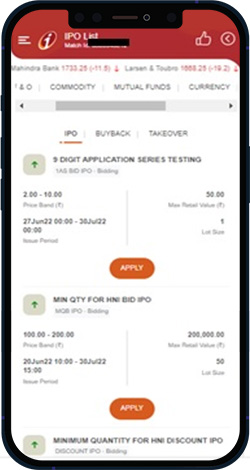

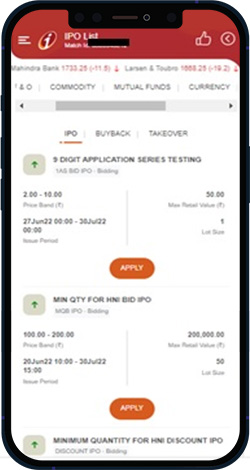

Go to the IPO section, select the IPO you want to apply from the list and click on ‘Apply’.

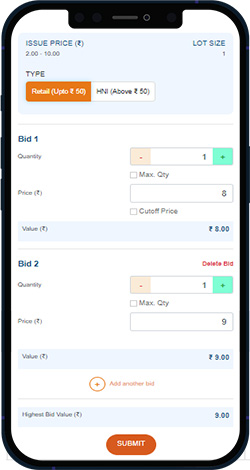

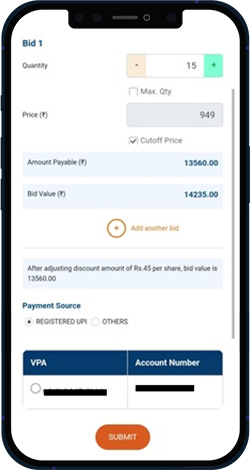

Fill in the quantity of the number of shares you want to buy. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

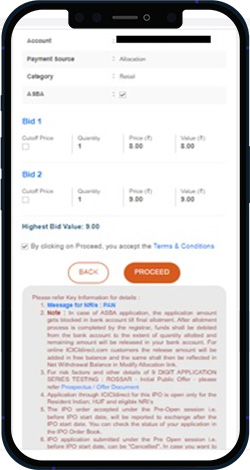

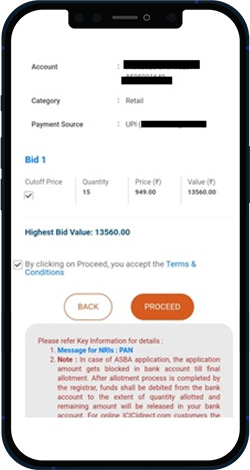

Click on proceed to confirm the order. You can view the placed order under “order book”.

Choose the IPO you want to apply from the list. Click on Apply.

Fill in the quantity of shares. To apply at maximum price, check the cut-off price box and amount is auto calculated. If you want to apply at some other price within the price band, then you can enter the price manually by clicking on “Add bid” option.

Check the A/C, UPI details and click on proceed. You will get an UPI link by which payment can be made.

Trusted by

customers

Investments & Liability Products

Investment Basket

Access to

Disclaimer – I ICICI Securities Ltd. ( I-Sec). Registered office of I-Sec is at ICICI Securities Ltd. - ICICI Venture House, Appasaheb Marathe Marg, Prabhadevi, Mumbai - 400 025, India, Tel No : 022 - 6807 7100. I-Sec is acting as a distributor to solicit bond related products. All disputes with respect to the distribution activity, would not have access to Exchange investor redressal forum or Arbitration mechanism. The contents herein above shall not be considered as an invitation or persuasion to trade or invest. I-Sec and affiliates accept no liabilities for any loss or damage of any kind arising out of any actions taken in reliance thereon. Investments in securities market are subject to market risks, read all the related documents carefully before investing. The contents herein mentioned are solely for informational and educational purpose.